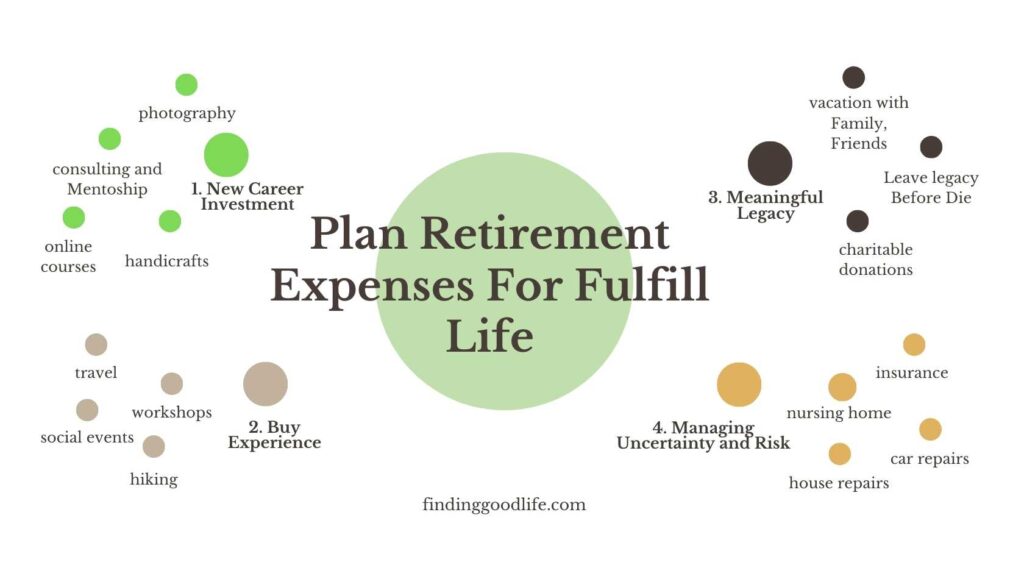

Are you only thinking about your basic needs in retirement, or can you imagine a more fulfilling life? Have you considered pursuing a new career or leaving a lasting legacy? Investing in experiences you desire is important, but don’t forget to plan for potential risks and unexpected expenses. I’ve gathered some valuable tips on wise retirement spending from different perspectives. I hope these suggestions inspire you and prove helpful. I’ve also shared my personal views and experiences at the end of each topic. Keep in mind that we all have unique perspectives, so take some time to see if these tips resonate with you

- Aligning Your Spending with What Matters Most

- It is not just essential, but it maximizes life experience and balances art.

- Lifetime Earnings: Exploring Long-Term Career Options in Retirement

- Exploring Post-retirement Career and Using Technology.

- Include potential income in your retirement financial planning

- Some Non-Financial Advice on Retirement Career:

- Buy Experience: Creating Lasting Memories in Retirement

- Buy Experience, Enjoy Experience, Create Memory For Your Happiness

- Building a Meaningful Legacy: Using Your Retirement Savings to Impact Loved Ones and Communities

- Managing Uncertainty and Risk in Retirement

- Conclusion: Love Life to the Fullest

Aligning Your Spending with What Matters Most

When planning for retirement, it’s common to focus on money and basic needs. But it’s also crucial to think about living a fulfilling life.

It is not just essential, but it maximizes life experience and balances art.

Not just necessities. Instead of just budgeting for necessities, consider how to use your retirement funds to maximize your life experiences. Whether traveling to new places, pursuing hobbies you’re passionate about, or simply enjoying quality time with family and friends, aim for a satisfying and complete retirement.

It is about balancing art. It’s crucial to balance enjoying your life now and preparing for future uncertainties. Start by reflecting on what truly matters to you. By aligning your spending with your values and priorities, you can create a retirement that brings you joy and fulfillment.

This approach enhances your quality of life and ensures that your retirement years are spent in meaningful ways that resonate with your desires and aspirations.

My Advice (Financial): Think big picture, plan expenses dynamically:

Think Holistically. When Planning For Retirement, It's Useful To Consider More Than Just Your Current Expenses. Think About The Overall Picture Of Your Future Life. Expenses Might Change Over Time. Some Might Increase (Like Medical), and Others Might Decrease Or Stop After A Certain Age (Like Travel or car). This Can Allow You To Plan Better For Your Overall Life.

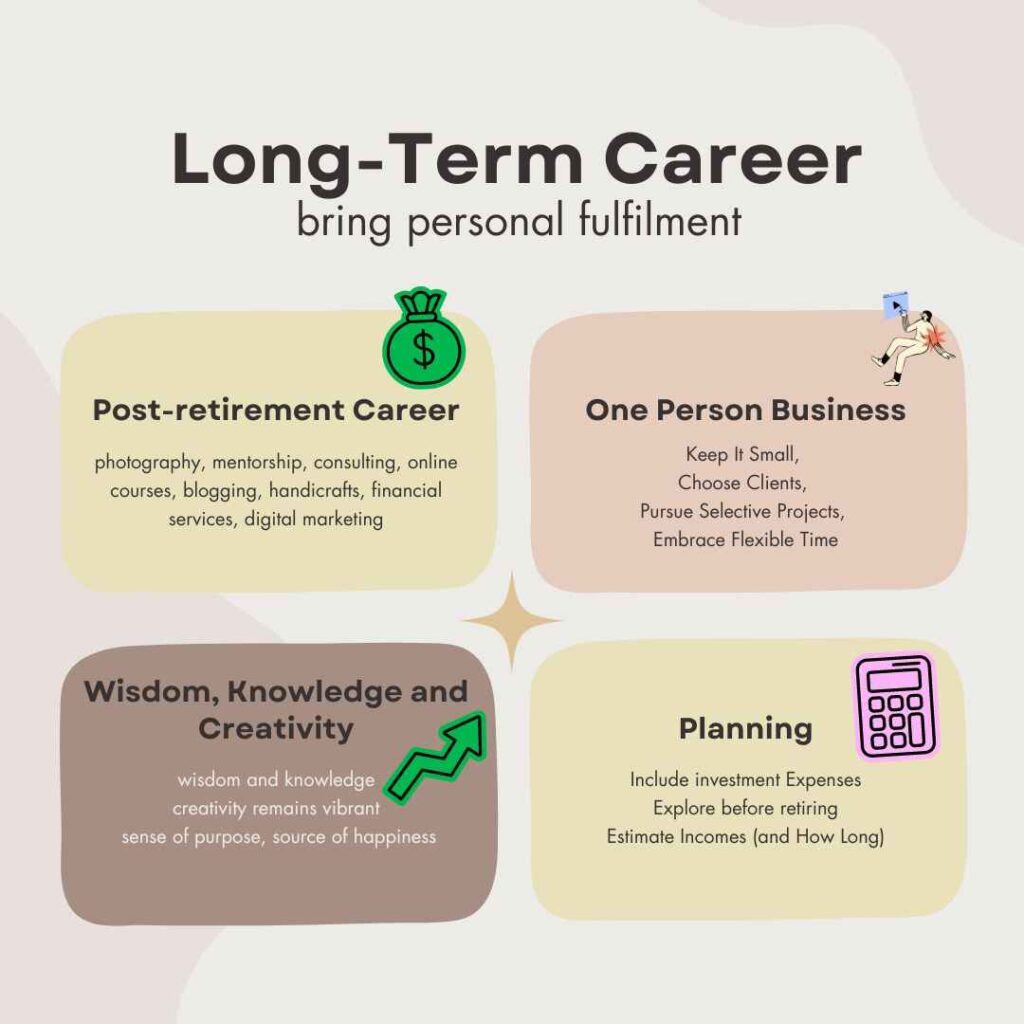

Lifetime Earnings: Exploring Long-Term Career Options in Retirement

Retirement doesn’t have to mean the end of your career journey. Instead of stopping altogether, consider pursuing a new passion or interest to sustain you financially and bring you personal fulfillment.

Exploring Post-retirement Career and Using Technology.

Your post-retirement career could involve photography, mentorship, consulting, online courses, blogging, handicrafts, financial services, digital marketing, or running a one-person business in any field you’re passionate about.

Advancements in technology, such as AI and virtual work opportunities, make it possible to continue working and earning income while enjoying flexibility and personal growth. Embrace these opportunities to stay engaged, feel purposeful, and contribute to society.

Include potential income in your retirement financial planning

If you choose a new career, understanding your potential earnings over your lifetime is crucial for effective retirement planning. By exploring alternative career paths aligned with your passions, you can enhance your financial security and enjoy a fulfilling retirement lifestyle.

Some Non-Financial Advice on Retirement Career:

Advantages of Getting Older: Wisdom, Knowledge, and Creativity

In From Strength to Strength: Finding Success, Happiness, and Deep Purpose in the Second Half of Life, Arthur Brooks highlights that while our fluid intelligence (the ability to solve abstract problems and adapt quickly) may decline with age, our crystallized intelligence (wisdom and knowledge) continues to grow. Simultaneously, Mind Shift: It Doesn’t Take a Genius to Think Like One emphasizes that creativity remains vibrant as we age. According to the World Happiness Report, having a sense of purpose is among the top sources of happiness globally.

Keep It Small, Choose Clients, Pursue Selective Projects, and Embrace Flexible Time

Drawing from both books, Company Of One, and Anything You Want: 40 Lessons for a New Kind of Entrepreneur, consider these critical takeaways for post-retirement careers: Keep your company small. Align your work with your lifestyle—work for a few months, then take breaks. Focus on what you love: exciting projects and serving select clients with high-quality work. Decide what to delegate (what doesn’t interest you) and what to keep (as you like) while prioritizing personal interests over commercial considerations.

My Advice (Financial): Career investment, Explore paths before retiring, Include Income

Include career investment in your retirement plan. Explore potential paths before retiring, even if you’re uncertain.

Doing so beforehand allows for better expense planning. If you only consider this after retirement with a guessed amount, you might feel stressed during explorations. Imagine depleting your budget without finding a satisfying path.

Should you continue exploring by reallocating funds from other areas? Consider including it in your retirement planning if you’re confident about your income and anticipate staying in this career (especially if you love it and health permits). Monitor it throughout your retirement to ensure financial stability.

My Experience: From Relaxation to Hard Work, with Increased Self-Worth and Creativity

This topic is not related to me, money-wise, but it does relate to me, life-wise.

During my initial retirement, I used to focus on checking out of investment, learning, reading, and exercising because they made me happier and more relaxed. But it felt like having dessert without a main course—I didn't experience delight. I started another blog but didn’t take it seriously then. Maybe I thought retirement meant avoiding stress.

When I started writing apps and having my blog, I found my main course. However, I have no intention of pursuing entrepreneurship yet, as I prefer focusing on perfecting what interests me. I can follow my path, keep exploring and learning, try different ways, and have my terms without worrying about the market or commercials (it is just about me. Entrepreneurship might give you different challenges and happiness).

I haven’t noticed a decline, although I may not be as sharp as when I was younger. Overall, I feel good, and that’s sufficient motivation for me to pursue anything, whether it involves fluid intelligence or crystallized intelligence. In my personal experience, I’ve strongly felt the power of cross-disciplinary insights. They serve as the foundation for my creativity, allowing me to interpret concepts differently and find unique perspectives.

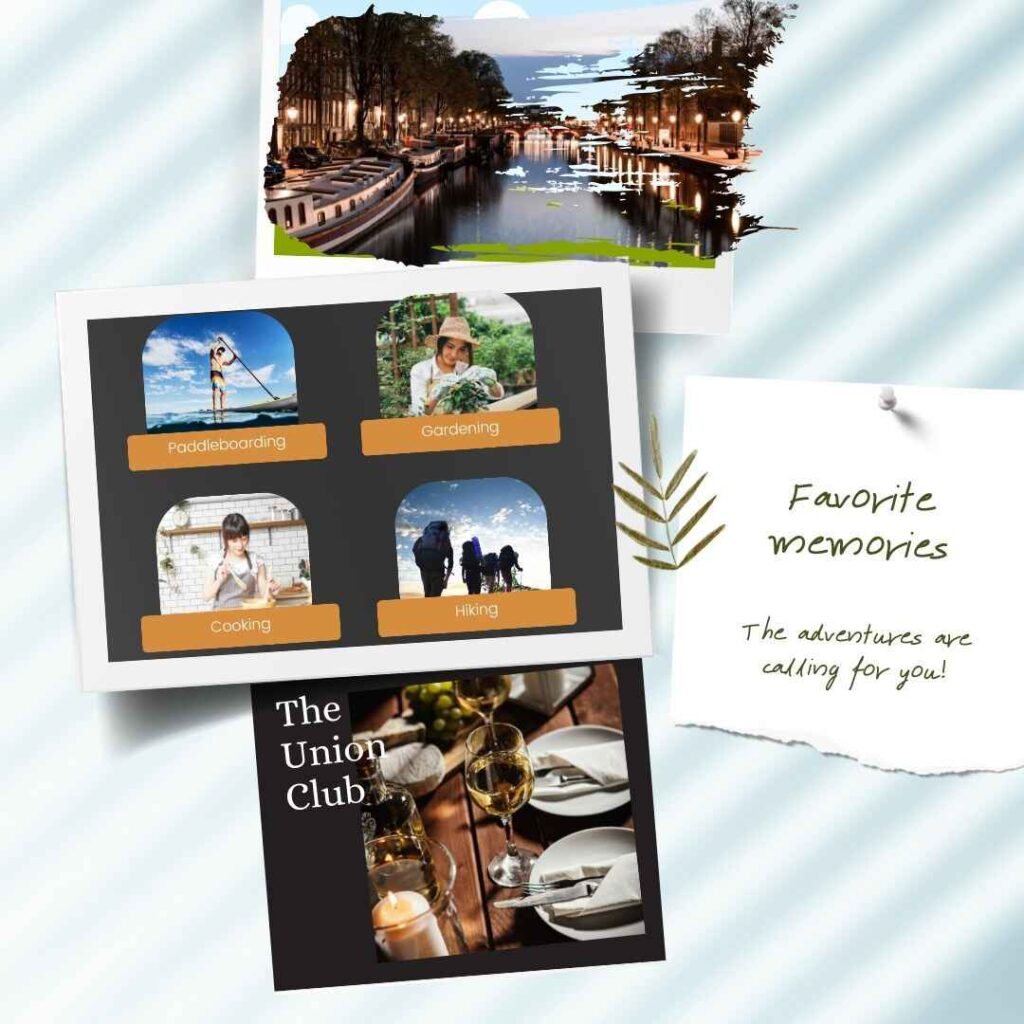

Buy Experience: Creating Lasting Memories in Retirement

Spending on experiences can significantly enrich your retirement. Instead of focusing only on material things, prioritize activities that create lasting memories and boost your happiness.

Buy Experience, Enjoy Experience, Create Memory For Your Happiness

Use your retirement funds for travel, workshops, cultural activities, cooking classes, hiking, social events, and dining out at new places. These experiences help you live fully in the moment and enjoy life to the fullest.

Experiences are more valuable than things because they create lasting memories. When you engage in activities that bring you joy, you’ll create memories that stay with you. These memories can make you feel the same excitement and emotions when you reflect on those experiences.

The book Flow: The Psychology of Optimal Experience explains how positive memories can bring happiness during tough times. Investing in experiences improves your life now and builds a store of happy memories for your retirement years.

My Advice (Financial): Hobbies Investment, Explore interests before retirement

While you pursue your hobbies, Starting part-time on hobbies before retirement would be beneficial, as you might think you like it but discover you don’t. If there are costs involved, you could spend a lot while exploring. Therefore, testing this before retirement is better for estimating your expenses.

My Experience: Not only the experience but material that matters to me

I don't entirely agree with the material part. During retirement, I enjoyed various activities, such as attending coffee workshops, visiting different cafes to change scenery, and participating in a 10km run.

I believe staying active and engaging in such activities creates beautiful memories.

Regarding materials, I don't seek luxury in material things, but I do value quality, especially for items I use frequently and long-term. I also enjoy having coffee outside occasionally because it's not just about the coffee; it's also about enjoying the environment.

So, what experiences and material possessions do you enjoy in the moment and over time? Reflecting on your experiences can help you determine what to include in your retirement planning.

Building a Meaningful Legacy: Using Your Retirement Savings to Impact Loved Ones and Communities

Your retirement savings can create a lasting legacy beyond your immediate family. Consider how you can use your money to impact the lives of loved ones, friends, and your community.

Start by investing in experiences that strengthen bonds with your loved ones and friends. Whether sharing a memorable dinner or going on a vacation together, these moments create lasting memories and deepen connections. As per the World Happiness Report, family relationships—whether with a partner or children—are among the top sources of happiness globally.

Additionally, according to the book Die With Zero: Getting All You Can from Your Money and Your Life, budget your money for your children and loved ones earlier rather than after you die if you want to leave them a legacy. Providing financial assistance early on can significantly favor their lives and future opportunities.

Beyond personal relationships, consider giving back to your community through charitable donations. Supporting local causes that align with your values leaves a positive impact and fosters a sense of community and shared responsibility.

By prioritizing these actions, you’re building a legacy of love, support, and generosity that will resonate through generations. Your retirement savings can serve as a tool to enhance the lives of those around you, creating a meaningful and enduring impact.

My Experience: Stop Donation? Free App

Initially, I had planned to stop making donations in retirement, but I changed my mind because I believe it's important to continue helping others. I have also started developing free apps, hoping that people will find them useful. In the future, I intend to explore more ways to contribute and make a positive impact.

Managing Uncertainty and Risk in Retirement

Planning for potential health-related issues and unexpected expenses is crucial to achieve peace of mind in retirement.

This includes having a comprehensive insurance plan that provides adequate coverage for hospital stays, surgeries, medications, and other healthcare needs that may arise as you age, preparing for medical bills that insurance may not cover, co-pays, and deductibles, and considering the possibility of needing long-term care in a nursing home. It’s also essential to ensure that your healthcare needs do not burden your children with time and money. You may need to include medical checkups and possible supplements in retirement planning.

Consider seeking advice from a financial planner. It helps manage healthcare costs and insurance wisely, ensuring economic security and peace of mind in retirement.

Retirement often comes with unexpected expenses like house repairs, car repairs, or other unforeseen costs. To avoid panic or stress when these situations arise, it’s wise to have a financial buffer. Set aside funds for these unexpected expenses to provide a cushion to absorb these shocks without disrupting your overall economic stability.

By addressing these aspects, you can enjoy your retirement years with greater peace of mind, knowing that you are well-prepared for any health-related challenges or unexpected expenses that may come your way.

My Experience and Advice (Financial): Upgrade Insurance, Unexpected Costs Budget, Nursing Home?

Before retiring, I upgraded my insurance, budgeted for medical expenses and accounted for high inflation. I also set aside money for unexpected costs.

Now that I’m retired, this planning helps me handle expenses without stress. If retirement planning doesn't include this, the stress could be pretty high, as extra spending means there is no 'replacement' income, or you need to save elsewhere to compensate.

Conclusion: Love Life to the Fullest

These ideas encourage you to invest time, money, and energy into experiences and relationships that truly matter. By doing this, you open yourself up to a world of possibilities. Whether you’re traveling, pursuing your passions, giving back to your community, or creating lasting memories with loved ones, the positive impact you’ve made and the lives you’ve touched will define the legacy you leave behind.

Our time on earth is limited. Let it inspire you to live purposefully, cherish each moment, and focus on things that bring you joy and fulfillment. This way, retirement becomes more than just a phase of life. It becomes a meaningful journey filled with purpose.